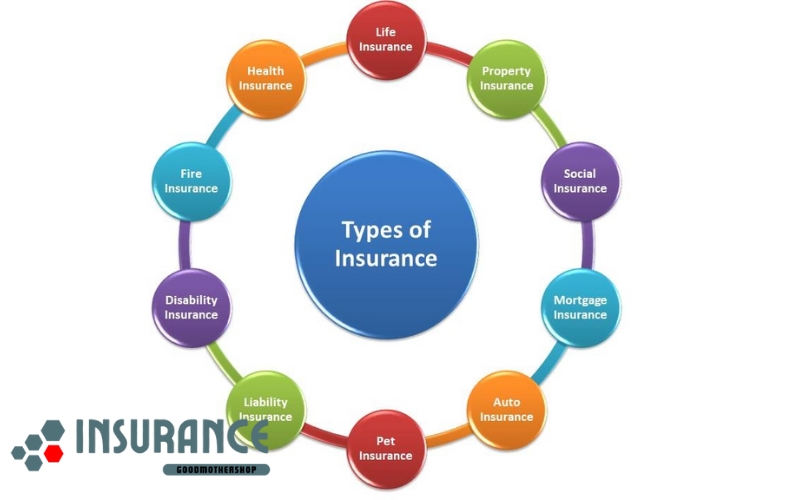

Insurance is an important financial tool that helps reduce risks and protect people’s assets, health and lives from unforeseen incidents. With the strong development of the insurance industry, today there are many different types of insurance to meet the diverse needs of customers. Each type of insurance brings specific benefits and protection to different groups of subjects, from individuals to businesses. In this article, we will learn about popular types of insurance, their characteristics and why they are important to the financial security of each individual.

LIFE INSURANCE

Life insurance is one of the most important and popular types of insurances, helping to protect people from health and life risks. This type of insurances not only brings peace of mind to participants but is also a long-term savings and investment tool.

Life insurance can include benefits such as paying beneficiaries in the event of the insured’s death, or paying financial support when the insured is seriously ill or permanently disabled. In addition, life insurances also includes insurance contracts that combine savings or investment, helping the insured accumulate finances throughout the insurances period.

The main benefit of life insurance is to help the insured and their family reduce the financial burden when facing unexpected incidents, while providing financial protection for relatives in the event of the insured’s death.

HEALTH INSURANCE

Health insurances is a type of insurances that helps pay for medical expenses, medical examinations, medicines and surgeries when the insured is sick or has health problems. This is one of the essential types of insurances in life, especially in the context of increasing medical costs.

Health insurances can include benefits such as payment for inpatient and outpatient treatment, tests, periodic medical examinations, as well as support for the cost of other medical services. Some types of health insurance also provide comprehensive health care services such as vaccinations, periodic medical examinations, or health consultations.

For those with a history of illness or special health care needs, health insurances helps them reduce treatment costs and access quality medical services. This is a comprehensive health protection solution and brings peace of mind to participants.

VEHICLE INSURANCE

Vehicle insurance is a type of insurance that helps protect vehicle owners against property damage and personal injury in the event of a traffic accident. This is one of the mandatory types of insurances for vehicle owners in many countries.

There are two main types of auto insurance: property damage insurance and liability insurance. Property damage insurance protects your vehicle against risks such as collision, breakdown, fire or theft. Liability insurances, on the other hand, protects you in the event that you cause an accident to someone else, including medical expenses for the injured and damage to third-party property.

Auto insurances helps drivers avoid large expenses if an accident occurs, while protecting their legal rights when participating in traffic.

PROPERTY INSURANCE

Property insurances is one of the most common types of insurance, helping to protect the assets of individuals or businesses against risks of natural disasters, fire, theft and other incidents. This type of insurances can be applied to assets such as houses, cars, machinery, equipment and other valuable assets.

Property insurance helps owners protect their assets from unexpected risks. When assets are damaged due to unforeseen causes, insurances will pay compensation to help owners restore their assets. This is especially important for high-value assets, such as houses or expensive equipment, helping to minimize the financial burden when an incident occurs.

BUSINESS INSURANCE

Business insurances is a type of insurances specifically for companies and businesses, helping to protect them from risks related to finance, property, personnel and business production activities. This is an important part of a business’s risk management strategy, helping to protect the company’s finances and sustainable development.

Business insurances can take many forms, including property insurances, liability insurances, employee insurances, and business interruption insurances. Each of these types of insurances helps protect a business from unforeseen risks, from property damage, legal liability, to incidents that can affect business operations.

Having business insurancsgives a company financial peace of mind and the ability to quickly restore business operations after unexpected incidents.

TRAVEL INSURANCE

Travel insurances is a very necessary type of insurances for those who travel frequently and participate in tours. This type of insurances provides protection for travelers against risks that may occur during the trip, from health problems to incidents such as lost luggage, flight cancellations, or accidents during the journey.

Travel insurancse gives travelers peace of mind when traveling, especially when traveling internationally. Insurances benefits can include medical expenses, accident treatment, loss of luggage, or even financial protection in the event of a flight cancellation.

ACCIDENT INSURANCE

Accident insurances is a type of insurance that helps pay for expenses related to unexpected accidents, from traffic accidents to incidents in everyday life. This insurances provides financial protection when the participant is injured, unable to work, or even dies due to an accident.

The benefit of accident insurances is that it helps reduce the financial burden on families and loved ones when the participant is unable to work or encounters serious risks.

CONCLUSION

Insurances plays an extremely important role in protecting people’s assets, health and lives from unforeseen risks. Each type of insurances serves different needs and purposes, from protecting personal health to protecting assets, businesses or families. Participating in insurances helps you feel more secure in unexpected situations, while protecting your personal and family finances throughout your life.